Contrasting the most effective Secured Credit Card Singapore Options for 2024

Contrasting the most effective Secured Credit Card Singapore Options for 2024

Blog Article

Revealing the Possibility: Can Individuals Released From Bankruptcy Acquire Credit Scores Cards?

Comprehending the Impact of Bankruptcy

Personal bankruptcy can have an extensive effect on one's credit score, making it challenging to gain access to credit score or fundings in the future. This financial discolor can remain on debt records for several years, impacting the individual's capacity to secure favorable rate of interest prices or economic opportunities.

Additionally, personal bankruptcy can restrict job opportunity, as some employers perform credit history checks as part of the employing process. This can position an obstacle to people looking for brand-new task leads or profession developments. Overall, the influence of bankruptcy expands past financial restraints, affecting numerous facets of an individual's life.

Factors Influencing Bank Card Approval

Getting a charge card post-bankruptcy is contingent upon various vital variables that considerably influence the approval process. One critical variable is the candidate's credit rating. Adhering to personal bankruptcy, people often have a reduced credit score due to the negative impact of the personal bankruptcy filing. Bank card firms normally look for a credit rating that demonstrates the candidate's capability to manage credit scores sensibly. An additional crucial factor to consider is the candidate's revenue. A secure revenue reassures credit score card companies of the person's capacity to make timely repayments. Furthermore, the size of time because the insolvency discharge plays an important role. The longer the period post-discharge, the more desirable the chances of approval, as it shows economic security and accountable credit actions post-bankruptcy. Furthermore, the kind of bank card being obtained and the issuer's specific demands can additionally affect approval. By thoroughly considering these aspects and taking actions to restore credit report post-bankruptcy, individuals can improve their prospects of getting a credit history card and working towards economic healing.

Actions to Rebuild Credit Report After Insolvency

Restoring credit scores after bankruptcy requires a tactical approach concentrated on financial technique and regular financial debt administration. The very first step is to assess your credit history record to make sure all financial obligations consisted of in the personal bankruptcy are properly reflected. It is necessary to develop a budget plan that prioritizes financial obligation settlement and living within your methods. One efficient method is to acquire a safe bank card, where you transfer a specific amount as security to develop a credit line. Prompt payments on this card can demonstrate liable debt usage to potential loan providers. In addition, think about becoming a licensed customer on a family members participant's charge card or discovering credit-builder fundings to additional boost your credit history. It is vital to make all settlements promptly, as repayment background dramatically affects your credit report. Perseverance and determination are essential as restoring credit history takes some time, yet with dedication to seem financial methods, it is possible to boost your creditworthiness post-bankruptcy.

Secured Vs. Unsecured Credit Rating Cards

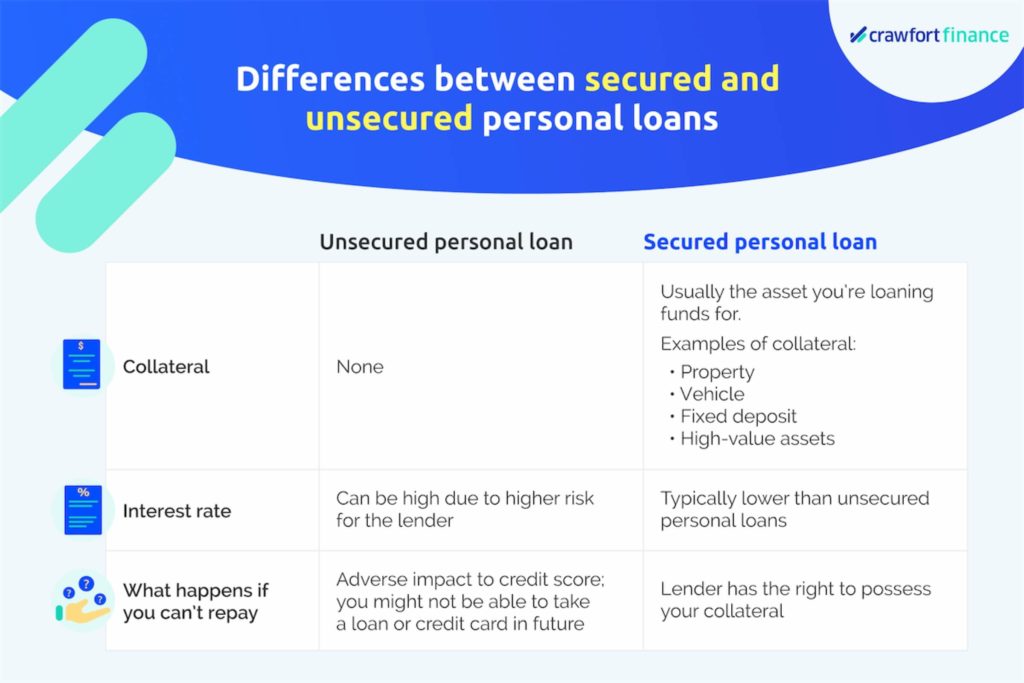

Adhering to Recommended Reading personal bankruptcy, people often take into consideration the selection between protected and unprotected credit report cards as they intend to restore their credit reliability and economic security. Guaranteed credit report cards call for a cash deposit that serves as security, generally equal to the credit score limitation provided. Inevitably, the option in between protected and unsecured credit score cards need to line up with the individual's economic goals and ability to handle credit report properly.

Resources for People Seeking Credit Scores Reconstructing

One important try this web-site resource for people looking for debt rebuilding is credit rating therapy agencies. By working with a credit report therapist, people can get understandings right into their credit score reports, find out approaches to improve their credit report scores, and get support on managing their finances efficiently.

An additional practical source is credit rating monitoring solutions. These services permit people to maintain a close eye on their credit rating records, track any modifications or errors, and spot possible indications of identification theft. By checking their credit scores routinely, individuals can proactively deal with any type of problems that might develop and guarantee that their credit score information depends on day and exact.

Additionally, online tools and sources such as credit report simulators, budgeting apps, and monetary literacy sites can provide individuals with important info and tools to aid them in their credit scores rebuilding journey. secured credit card singapore. By leveraging these sources successfully, individuals released from insolvency can take meaningful actions in the direction of improving their credit score wellness and securing a far better financial future

Conclusion

Finally, people discharged from bankruptcy might have the chance to obtain charge card by taking steps to rebuild their credit history. Aspects such as credit scores history, debt-to-income, and income ratio play a substantial duty in bank card authorization. By recognizing the influence of personal More Bonuses bankruptcy, choosing in between protected and unsecured charge card, and making use of sources for credit report restoring, individuals can boost their creditworthiness and possibly acquire accessibility to credit scores cards.

By functioning with a credit therapist, people can obtain understandings right into their credit rating reports, discover techniques to improve their debt scores, and get advice on handling their finances effectively. - secured credit card singapore

Report this page